Growing Your High Net Worth Clients

If you're a financial advisor or a wealth management firm, the US is experiencing one of the most significant opportunities for you to market to potential UHNW or HNW clients.

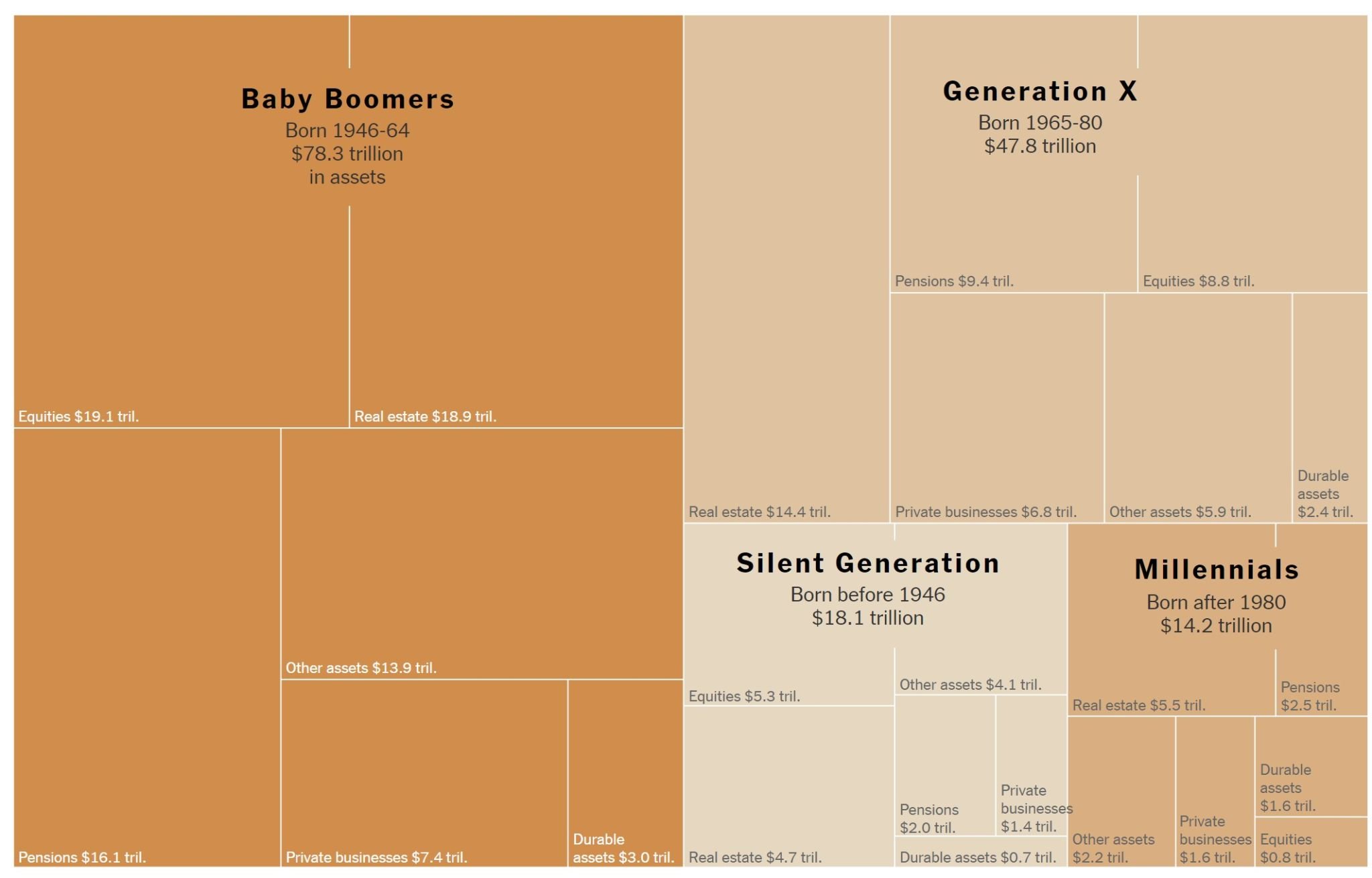

Boomers have $78.5 trillion in assets.

Multicultural Clients are a growing segment. Over 1 million HNWIs are Black, Asian, Hispanic, or Latin in origin.

Underserved Young Professionals, like Millennials, already hold $14.2 trillion in assets.

Source: The New York Times

How Do I Market To UHNWI and HNWIs?

As of 2021, there are about 233,000 UHNWIs in the US. Sounds nice, right? Not so much when you realize there are 330,000 financial advisors in the US. That’s a tough ratio, and it will take more than a few marketing emails to win them over. You’ve got a slight advantage if you’re one of the approximately 15,000 Registered Investment Advisors (RIAs). However, with the introduction of robo-advisors and the numbers expected to increase, competition is only getting tougher.

Looking at HNWI, the sea is a lot bluer - there are about 7.5 million in the US. It's still a tight market, but one that allows for client growth for your firm as well as helping create new HNWIs.

Diving into marketing directly to each of those demographic segments, it’s not always about the tools you use for marketing, but the ideas of exactly how to market to them. For each potential client segment, focus on one essential item that matters to them.

Boomers. Help them think longer term about their own wealth transfers or cater to younger generations that are set to inherit assets.

Multicultural Clients. Help ensure progressive wealth building for present and future generations while focusing on their unique needs.

Underserved Young Professionals. Many advisors tend to look for soon-to-retire clients. But many young pros are hitting their earning potential. Establish trust with those that want an advisor to help them through what's to come in their financial journey and become a HNWI.

Like all plans, marketing or financial, this is about the long game. Reassess at least twice a year and determine if you need more resources to help or if you need to segment your efforts further.